|

|

| Home | About Us | Success Stories | Farmers Association | Farmers' Innovation | Publications | Contact | |

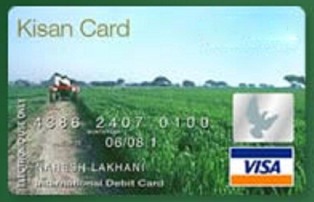

Banking & Credit :: ALLAHABAD BANK

A unique scheme for farmers under which they can draw loan amount in cash for crop production as well as domestic needs from the card issuing branch within the sanctioned limit. The details are as under: Eligibility: Farmers having agricultural land & Pattaholders (i.e. land allotees). Card is also issued in joint names where landis owned jointly. Loan Limit: Limit is fixed to meet the cost of cultivation of crops based on land holding and also for domestic needs. There is no minimum or maximum loan limit. Validity: For further details Click here It envisages to provide farm investment credits as well as personal/domestic loans including repayment of debt to money lenders. The details are as under: Eligibility: All existing Kisan Credit Card holders and all other farmers who are eligible for Kisan Credit Cards. Loan Limit: The permissible loan limit will be 50% of the value of land OR 5 times of net Farm Income whichever is lower, LESS outstanding amount, if any, in Agril. Term Loan account(s) subject to maximum Rs.5.00 lacs.Maximum 50% of the loan limit may be utilised for personal/domestic purposes. For further details Click here Source: http://www.allahabadbank.com/ |

|

| Home | About Us | Success Stories | Farmers Association | Farmers Innovation |Publications|Disclaimer

| Contact Us

© 2016 TNAU. All Rights Reserved. |

|