|

|

| Home | About Us | Success Stories | Farmers Association | Farmers' Innovation | Publications | Contact | |

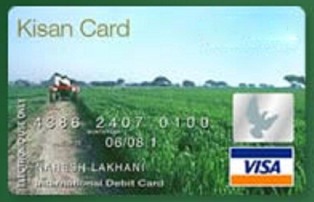

Banking & Credit :: UNITED BANK OF INDIA

Objective: The scheme aims at providing adequate and timely credit for the comprehensive credit requirements of farmers for taking up agriculture and allied activities under single window, with flexible and simplified procedure, adopting whole farm approach, including the short-term credit needs and a reasonable component for consumption needs, through Kisan Credit Card including repayment of farmer's dues to non-institutional lenders. Area of operation: Through all rural and semi urban branches. Eligibility:

Purpose: It is intended that both term as well as short term/working capital credit facilities will be provided through single Kisan Credit Card. The passbook provided to KCC holders are to be divided into three separate portions for maintaining the records of :-

2. United Krishi Jalaghu Paribahan Yojana Objective: To provide financial assistance to the farmers for acquiring three wheelers, to be used as a transport equipment for carrying agricultural inputs and farm produces Area of operation: Through all rural and semi urban branches Eligibility: The farmers owning lands or no land but having driving license will be eligible for the loan. Quantum of loan: Maximum upto Rs.1.00 lac. Source: http://www.unitedbankofindia.com |

|

| Home | About Us | Success Stories | Farmers Association | Farmers Innovation | Publications | Disclaimer

| Contact Us

© 2016 TNAU. All Rights Reserved. |

|