|

|||||||||||||||||||||||||||||||||||||

| Home | About Us | Success Stories | Farmers Association | Farmers' Innovation | Publications | Contact | |||||||||||||||||||||||||||||||||||||

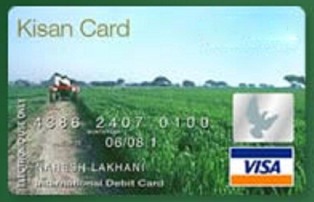

Banking & Credit :: UNITED BANK OF INDIA

Objective: The scheme aims at providing adequate and timely credit for the comprehensive credit requirements of farmers for taking up agriculture and allied activities under single window, with flexible and simplified procedure, adopting whole farm approach, including the short-term credit needs and a reasonable component for consumption needs, through Kisan Credit Card including repayment of farmer's dues to non-institutional lenders. Area of operation: Through all rural and semi urban branches. Eligibility:

Purpose: It is intended that both term as well as short term/working capital credit facilities will be provided through single Kisan Credit Card. The passbook provided to KCC holders are to be divided into three separate portions for maintaining the records of :-

2. UNITED KRISHIJA LAGHU PARIBAHAN YOJANA Objective:To provide financial assistance to the farmers for acquiring three wheelers, to be used as a transport equipment for carrying agricultural inputs and farm produces Area of operation: Through all rural and semi urban branches Eligibility: The farmers owning lands or no land but having driving license will be eligible for the loan. Quantum of loan: Maximum upto Rs.1.00 lac. 3. UNITED KRISHI SAHAYAK YOJANA Object / Purpose:

|

|||||||||||||||||||||||||||||||||||||

Eligibility: |

|||||

The project for construction of rural godown can be taken up by : |

|||||

i. |

Individual |

v. |

SHGs |

ix. |

Cooperative Societies |

ii. |

Farmers |

vi. |

Partnership / |

x. |

Agricultural Produce Marketing |

iii. |

Group of farmers |

vii. |

Companies |

xi. |

Marketing Board |

iv. |

NGOs |

viii. |

Corporations |

xii. |

Agro Processing Corporations |

7. GOLDEN JUBILEE RURAL HOUSING FINANCE SCHEME

Objective:

To redress the problem of rural housing through improved access to housing credit in rural areas, for construction of house, purchase of house/flat under construction or purchase of newly built ready house /flat /repair /renovation /extension etc.

Eligibility:

An individual customer including joint loanees, salaried persons professional and self employed business men and agriculturists having regular source of income. Promoters/Co-operative Societies/Associations/Staff are not eligible under the scheme.

Quantum of loan:

There is no ceiling on the quantum of loan provided by banks under the scheme. All loans extended by the banks in rural areas for housing purposes be included under the captioned scheme. However, it may be noted that refinance facility from NHB shall be limited up to a maximum of Rs.15.00 lac per dwelling unit under the scheme.

8. UNITED BHUMIHEEN KISAN CREDIT CARD

Objective:

The objective of the United Bhumiheen Kisan Credit Card (UBKCC) is to provide production credit coupled with the provision of consumption credit and credit for liquidation of loan availed from informal sector and for meeting genuine need of the farmers who are landless tenant farmers, oral lessees, bargadars and share croppers for availing working capital assistance for agriculture and allied activities like dairy, poultry, fishery, piggery, duckery, horticulture, nursery, ornamental fishery, vegetable orchard and bee-keeping, etc.

Eligibility:

1. Any individual belonging to the above category.

2. SHG/Joint Liability Group of the above category of farmers.

3. Contract farmers under tie-ups with sugarcane, potato, vegetables, fruits and horticultural crops processing units and other processing units in allied agricultural activities.

Limit:

a) Maximum Rs.25,000/- for all the above purposes together. Out of the above limit Rs.5000/- may be utilised for investment credit purpose if required by the borrower.

b) Consumption loan limit not to exceed Rs.2500/-.

c) Repayment of loans to informal sector maximum Rs.5000/- on the basis of documentary evidence and certified by the Panchayet Prodhan.

d) Scale of finance as fixed by District Level Technical Committee(DLTC) and unit cost fixed by NABARD will be applicable.

e) For cultivation of multiple crops different sub-limits to be fixed.

9. UNITED GRAMIN SAHAJ CREDIT CARD

The Salient features of United Gramin Sahaj Credit Card Scheme are as under:

Objective:

-

The scheme shall cover general credit needs of our customers in rural and semi urban areas. The objective of the scheme is to provide hassle free credit for any purpose to the customers based on the assessment of income / cash flow of the household without insisting for purpose & ensuring end use of the fund & without insisting collaterals etc. - in line with issuing of General Credit Card. Implementation

-

The scheme will be implemented in all rural and semi urban branches of the bank

Nature of accommodation:

The credit facility to be extended under the scheme will be in the nature of revolving overdraft facility. The UGSCC holder will be entitled to draw cash from the branch from where the limit will be sanctioned and a passbook will be issued stating the limit etc. affixing photograph.

Eligibility:

-

Any individual household having regular income from salary, business, profession and any other economic activities (Farm and Non Farm activities) like agriculture, pisiculture, dairy, poultry, piggery, duckery, transport operating, craftsmanship, artisanship, etc.

-

Preference to be given to women beneficiaries under the scheme.

10. UNITED SAHAJ RIN YOJANA (For North Eastern States Only)

Objective:

The objective of the "United Sahaj Rin Yojana" is to provide overdraft facility for pursuing any income generating activities in the farm and non-farm sector (any eligible activities). The scheme is meant for weaker section of the society under priority sector for bringing the small traders like Pan Bidi vendors, vegetable / fish vendors, fruit vendors, newspaper hawkers, fast food stalls, phoochka stalls, etc. The scheme is aimed to avoid borrowing by these very small traders from private money-lenders at very high rate of interest.

Eligibility:

Any individual in the age group of 18-50 yrs. belonging to BPL list and undertaking the above-mentioned activities, and residing in the vicinity of the branch preferably within 1 to 1.5 km. from the Branch for proper monitoring. All existing defaulter loanees will be kept outside the purview of the scheme.

Implememtation:

To start with the implementation of the scheme will be restricted to all branches under North Eastern States only.

For further details Click here

Source: http://www.unitedbankofindia.com

Home | About Us | Success Stories | Farmers Association | Farmers Innovation |Publications|Disclaimer | Contact Us

© 2016 TNAU. All Rights Reserved.